[Source] https://www.aier.org/article/when-financial-markets-bubble-theres-something-for-everyone/

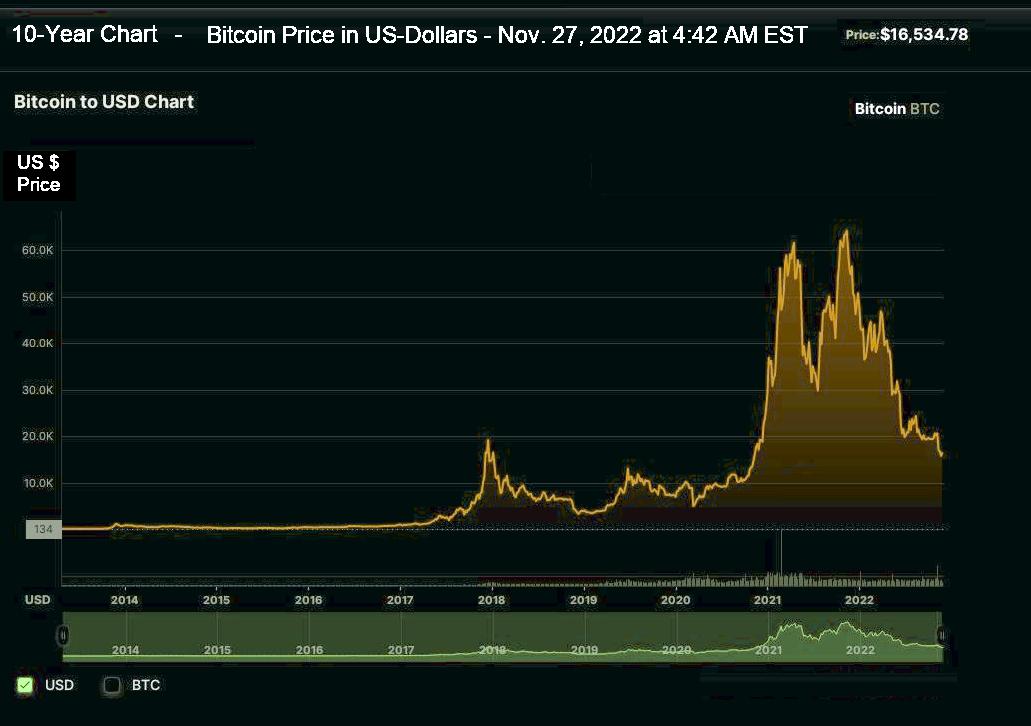

This chart is from American Institute for Economic Research, lifted from book by Thomas Levenson on the South Seas "Bubble". It is difficult to get solid price data from 300 years ago, but it is not impossible. Contrary to the usual nonsense published about this event, there was an honest business purpose behind this company. It reminds me of CMGI stock price, during the "Dot-Com Bubble". Click on image to expand it. Look at how much this chart, looks like the one that follows it, for Bitcoin price.

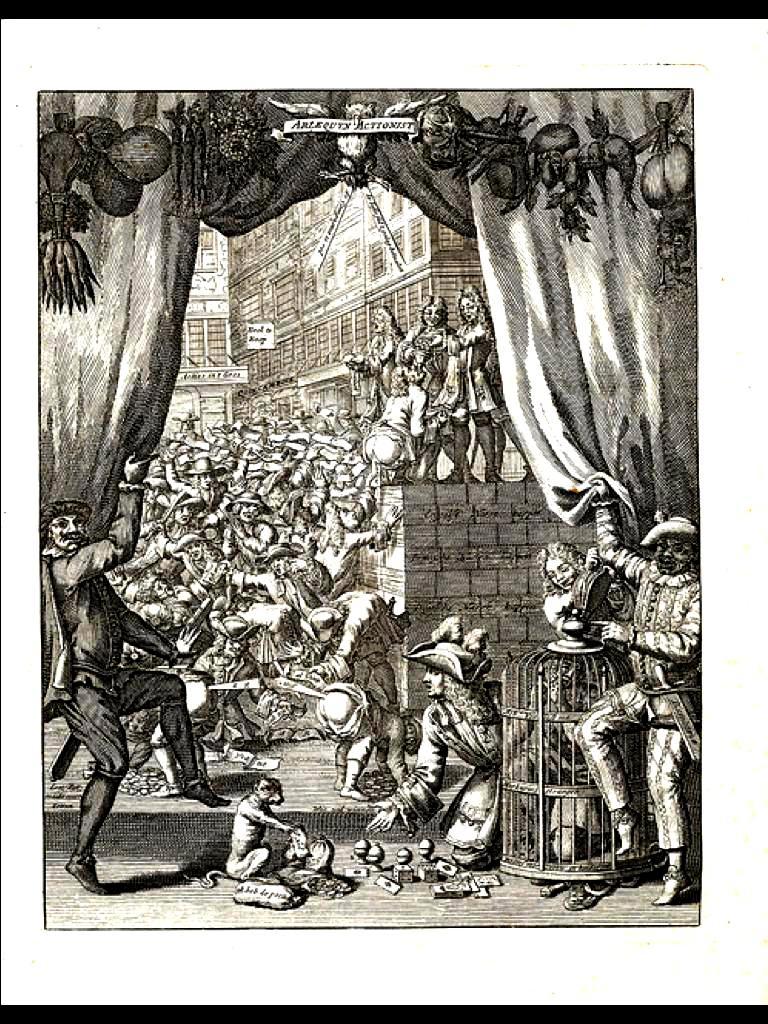

Crypto-Currency is Not New! - Look at this picture! It is satire - John Law is on a mountain of bank-notes, (the boxes), and he is being fed gold coins, and is shitting bank-notes, which folks are eagerly grabbing out of his anus. In foreground, two smaller players, are on each side of the crowd, doing the same thing, just behind the curtain. in the front, a bankrupt "aristo" in a fancy hat, is gambling with a *monkey*, and the monkey is winning big. A huge crowd of "millionaires" and wanna-be millionaires (this is when the word originated!) are crowded behind John Law's behind, and are furiously trading the soon-to-be worthless securities of the Mississippi Scheme, for the soon to be worthless bank-notes. FTX stock, and FTT tokens, perhaps? Kinda looks a lot similar, yes? John Law => SBF? Ya think maybe?

Crypto schemes look an awful lot like this satirical portrait of the Great Mississippi Bubble (which was really the first big "paper money" scheme, in France, in the 1720's). At first, it was a humongus success - most of the early-adopters got rich, and those who cashed out early, bought real-estate, and lived happy lives (for a while... until the next insane European war/revolution, and maybe even after, depending on which side they backed...)

Nothing changes - just the nature of the technology, and the mechanisms of trading and distribution.

Know this. Crypto currency is probably best used as a transfer medium and / or an asset class. It is not bullshit probably, but it certainly can be "human shit", in a process model almost exactly the same as the one depicted in this satrical image from after the John Law "Mississippi Scheme" collapsed.

Watching how fast the FTX Exchange collapsed in real-time is something I did not expect to see in 21st century. But then, I did not expect that Putin would invade Ukraine. (And no one ever expects the Spanish Inquisition...) It is Saturday, Nov. 12, 2022, and according to news reports from a few hours ago, all the "wallets" at FTX have been drained down to zero. So, this should make for an amusing "bankruptcy". The "bank" has not just ruptured, it has digitally vapourized, like someone shot with a phaser used to do, on Star Trek.

No Quatloos left, folks. Look at this picture, one more time. Which one are you?

Is Crypto-Currency Complete Bullshit?

Nov. 22, 2022 - More Crazy Crypto Comedy Capers - Ok, I guess the penny just dropped here.

Every generation needs to find this sh/t out for itself. The same toxic madness comes around every 25 or 30 years. In the 1960's, there was "Investors Overseas Services" - a complete sh/t-show of a scam, all based on brokers pedaling "globalization" ideas to wealthy doctors and dentists around the world. My dentist Dad bought some of the crap from his arrogant broker, and I still have the worthless shares from this bogus scheme. It sold well, because the brokers got big commissions to sell it.

In the 1970's, it was computer leasing firms. In the 1980's, it was real-estate -like it was in 2006-2009 (the Great Financial Crisis), and in the 1980's, it was self-dealing Savings and Loan operations in the USA. The scams are always being generated. In 1907, it was Heinz the "Copper King" and the Knickerbocker Trust of New York City - a very big, supposedly sound, Trust Company, that operated like a bank. Except they loaned way, way too much money to Mr. Heinz, and he lost it all (and more, actually), trying to "corner" the copper (an other markets, maybe) in Chicago (or something like that... completely stupid trading, but ego-driven, and terrible dangerous for all concerned).

The FTX collapse is not at all unique. It looks like a combo of outright theft, fraud, self-dealing, and then dipping into client funds to cover shortfalls, etc. Completely standard bad-bad financial behaviour from sh/t-flinging criminal skanks, who deserve what they will ultimately get.

Probably they will not do the honourable thing. But maybe they should.

The CEO of Knickerbocker did...

In October of 1907, the CEO of Knickerbocker Trust was so distraught that J.P. Morgan would not even meet with him, that he went home and on November 14th, 1907, he blew his brains out with a revolver. His name was Charles T. Barney, and his death was a sad thing, because he had actually worked out a plan - with his lawyers and bankers - to remain solvent, and when he died, his assets (mostly real-estate holdings) were worth $2.5 million more than his liabilities.

He was just mortified that JPM (the man) and the New York business community had thought he was a crook. The historical evidence suggests he was not - but the Knickerbocker was - to use the modern term - a shit-show of poor financial managment, big expenses, and unwise concentrated loans granted to arrogant fools who managed to blow themselves up. (Are you listening, CS?) When rumours spread that the Trust was out of money, a run began which lasted for days, until Knickerbocker had to close their withdrawal windows - and then they really *were* out of money.

They were finished, and no one would trust this Trust again.

Here, the FTX collapse - and the links to DCG, Genesis and other linked crypto-entities, seem to be playing out in a similar way. When a big firm with cross-dealings with other firms fails, the ripples can become tsunami-level quickly, if someone cannot honour their withdrawl requests.

I recall reading my little blue "bank book" as a child - and reading a tiny note at the back of it, that said the Trust Company (it was Waterloo Trust - which became Canada Trust, but I called it a Bank because I did not know better) could make me wait up to 30 days to withdraw funds deposited in my little savings account. I asked several folks why, and got that usual stupid laughter that people use when little children ask what they think are foolish questions.

Children - and banks - generally know what is happening, unless they are really stupid.

Banks & Trust companies wisely have restrictions on withdrawals. Not sure if they print these little warnings anymore, since no one has bank books, and most deposits are insured, up to $100,000. Read the details about FDIC insurance here:

https://www.canada.ca/en/financial-consumer-agency/services/banking/deposit-insurance.html

This is a good and fine thing.

But crypto assets and money deposited with these various crypto exchanges, do not appear to have any protection at all. None. Nada.

And it is looking like, they are often "Roach Motels" for your money. Your money can "check-in", but it might not be possible for it to "check-out".

Kids: You have to bloody well read the fine print. Don't let your greed, make you stupid!

So, today, the stock market is looking very frisky and our holdings are continuing to recover (after a pretty nasty meltdown over much of this year.)

But the crypto holdings - for folks holding that "asset class" - are not looking too good.

If you hold crypto - you probably want to keep it in an air-gapped, off-line wallet of some sort. If you keep any funds at an "exchange", they are at risk, and you have probably underestimated the level of risk you think you are taking on. (This happens *a lot* in the world of finance.)

I recall also, my father would invest in GIC's (which were not stupid investments in the 1970's and early 1980's.) You could get 11%, and better - sometimes for 5 years and such, which he knew was a bloody good rate of return, for a very low risk investment. He was also smart enough to split them - even at the same Bank - into different tranches (the bank had different subsiduary entities), so that each GIC was less than 60,000 dollars, (the old FDIC insurnace limit) so that if the Bank failed, the FDIC would cover the loss for each tranche. So, the investments were virtually zero risk.

My father was this guy who was a kid in the Great Depression, and who flew bombers in the RCAF during the Second World War, so he knew a bit about risk.

The Zerohedge guys have a good article on the FTX blowup and its links to => DCG (Digital Currency Group) and Genesis Capital (which has said it might have to file for bankruptcy):

https://www.zerohedge.com/crypto/crypto-conglomerate-dcg-trouble-genesis-verge-bankruptcy

More information below: (Careful, this website below opens weird pages and pop-ups. You might want to disable javascript. In Firefox, open a tab, enter "about:config", enter "java" in the search box, highlight "Javascript.enabled" in the list of hits, and click "Toggle" turn switch parameter from "True" to "False". With javascript disabled, you can read the info on the "theblock.co" site below, without the toxic, screen-locking popups from appearing...)

(Make sure to turn javascript back on when done, or other pages won't work right..)

What is really comical, is how weird things are getting. I had drinks at "Ethyls" with a friend who was telling me about this guy who is the son of a relative of his partner, a clever woman who does some interesting work, and this guy in question - based in Hamilton - works with two guys, creating NFT's. I assumed this was all bullshit, until he told me that Scott and his two associates have make $163 million real dollars, selling Scott's NFT "doodles". I thought maybe I heard the numbers wrong, so I had a sip of my dark-rum-on-ice, and asked for more details. My friend whips out his phone, and shows me the artist's work. They are pretty damn clever - but the numbers seemed beyond human belief. But I had read Brian Page's book the day before at the Conestoga Mall Indigo bookstore, and it seems this is just crypto-enabled internet marketing, with a fine, solid super-sized funnel. Oh.

But it is artwork - and artwork is unlimited. I have a Norval Morrisseau in my office, and a couple of Alex Colvilles. Art is crazy subjective. You like something, and you have to have it. It's completely crazy. I gave my brother my father's Jean-Paul Riopelle when I was doing the estate, because I just don't like Riopelle. I think his work is silly, overated, like that fraudster Barnett Newman who painted that piece of shit called "Voice of Fire" that our fucking stupid National Gallery paid over 1 million USD for. Some artwork is just shit, and the artist puts a stupid number on it, because he can, and everyone buys into the bullshit, because they are all part of the same fraud, that milks the system to gain the cash. ("Art Professors" are the worst of all...)

And the key is - this is the business of the world. The entire world-city, is a fuck-hole of fraud and fakery and foolishness, that is at the same time both horrifically awful, and charmingly delightful. It's like in physics, where energy can be both wave and particle - at the same fucking time.

This is curious, and it just is - there is no rational reasoning behind it. I saw my first Colville and I had to have it. My Morrisseau is a work of extreme genius - and it made me rethink Indian Art in Canada - it is as good as anything done anywhere in history - and Morrisseau - the tortured spirit of "Copper Thunderbird" - his spirit name was given to him by his grandfather - is just plain magical-good. His teachers complained at his work, and told him to "blend his colours" - but he did not, and so his works have the authentic hyper-intensity of high-impact modern graphic arts, that is used in supermarkets to sell crap. But Norval just was pulling from his genius spirit soul.

His "Man Turning in to Thunderbird" series - exhibited at the McMicheal Gallery for a short while - just about knocked me over. It was positively cinematic - a series of paintings showing the eternal human desire to transcend who and what we are. It was visual magic.

So, when I heard about Scott's "doodles" and the insane revenue stream they are generating, I suddenly saw the whole crypto-space in a different light.

Of course crypto is bullshit.

But - and here is the curious key - just about everything is bullshit, and if crypto works at all, then maybe that is all one needs to know.

If crypto can enable artwork - then something very, very special is happening - whether you can know or accept it or not, Mr. Jones.

---

Just be bloody careful, and don't fritter away your stake, and get blown up in a fool's "gambler's ruin" scenario.

Here is the link to these wild Scott Martin NFT's... Some of them are crazy clever. Will they stand the test of time? Unclear. But "Burnt Toast" is a real thing... and something.. What something? I cannot really judge yet - but it is art, and Scott is creating it. And he is not having to wait to be dead, before his art-enterprise generates yield. This is both curious and charmingly delightful.

https://burnttoastcreative.com/

https://burnttoast.myportfolio.com/

--- 30 ---

Really. Is Crypto Currency Complete Bullshit?

Nov. 12, 2022

I have been searching on this topic, and found this good article:

https://modelcitizen.substack.com/p/is-crypto-bullshit

And, this is our take on this key question:

I found your note with a google search of "Is crypto currency complete bullshit". Because for serious players, this is the real question. Sequoia Capital & Ontario Teachers Pension Fund both

put serious money into FTX, and I am watching the slow-motion train-wreck of it's ugly colllapse. For me, FTX look a *lot* like the 1907 failure of Knickerbocker Trust, in New York City - right down to it all happening at the same time of the year.

Your note here is interesting and helpful. You make a valid case, in the last three paragraphs, and the penny dropped for me, when I read them. You nailed a key fact.

It's 4:47 am, as I key this, $662 *million* in FTT tokens

have been transfered out of FTX, in the last 24 hours, according to analytics firm Nansen. FTX - until recently one of the largest cryptocurrency exchanges - has filed for bankruptcy, and Bankman-Fried has shut down Alamada Research, his

trading company that appears to have been making a market in FTT coin.

This is not just bullshit - this looks a *lot* like old fashioned securities fraud and a pretty classical bank-run.

What is disturbing is that the "digital / distributed"

nature of the crypto-coin (or token, or whatever), has made it easy for an unknown party to successfully hack the bankruptcy process, and completely asset--strip FTX. The "investors" or "coin-holders" of FTT, will likely get nothing. Sequoia Capital

has written off - completely - it's $200 million US dollar investment, in FTX.

So, being here now, in the future - it looks pretty clearly, that perhaps not all crypto-currency is bullshit - but enough of it is, to render the entire concept suspect.

You *need* some centralization, just like you *need* some kind of government - even if it's just a pirate-ship captain's authority. Otherwise - the scammers / bad-guys / other-pirates will swoop in, and hoover up all the money, probably

at the locus-points (trading houses, market-makers) where the crypto is turned into real cash.

The thing that really makes us here lean to the "crypto is bullshit" thesis, is that the value from crypto coin is just too much like penny-stock - the

value comes from the link between the coin and real, honest, "coin of the Realm". If you sever that link, you have nothing. And that link gets severed - just like it does for junk stock market securities - when the initial *promoter

people" end their support, by cashing out, selling to the "suckers". The dreamers hold on to their junk stock, childishly thinking it might come back in value. But the market maker - like FTX has done - has raided it's customer accounts

to try to keep the liquidity flowing, and ends by financially killing all it's investors. In the end, your stock is worth nothing. And in this case, your crypto-coin is worth nothing if no-one will accept it for payment.

Your crypto-coins

go the way of every junk-stock pumped in a boiler-room scam, and every junk currency issued by "central bankers" of banana-republic junk governments, in corrupt countries run by either stupid people, or criminal people (often both, of course.)

And

this is just the truth of it.

You *cannot* get folks to believe in value, of your crypto-coins, if you do not link them to local "coin-of-the-Realm" money. And you cannot get that to happen, unless you have centralized "exchanges" or market-makers

of some sort, who are paid to promote the coin. And once you have centralized exchanges, then you run into *exactly* the same problem every brokerage operation and bank has always had.

But don't feel sad. All money is really bogus.

This is why gold, silver and copper/bronze/brass coins were used, for so long - thousands and thousands of years, and in every nation - Europe, China, Japan, Americas, Africa, etc. Even Africa (Read the "Travels of Mungo Park") Gold is decentralized.

The coins work as money - from ancient Babylon, to Greece to Rome - and right up until Nixon, in 1971 in USA took America off the gold standard. Gold is now an asset-class, more valuable than just money.

Gold and silver coins have value

- completely disconnected from any Government.

What we find in our investments, is that there is really very little that is truly ever "new".

And the key fact about crypto-coins, is they look an awful lot, like the very first experiments in

the use of paper-money, to replace gold and silver coins. (Read the details of John Law's scheme, as implemented in France, in the early 1700's)

But paper money has been successful. But it requires a good government, and an honest central

bank, run by folks who know what they are doing. (Not like the Reichsbank, in Germany, in 1920-24)

Although the decentralized nature of crypto-coin is attractive, it also means that it will suffer from the "Roach Motel" problem. You

can "check-in" and buy the stuff, but the "check-out" process where you convert your "coin" back into real money, will forever be fraught with high risk. (I am reminded of a bank for "non-tourists" that I saw in Mexico, where the local business folks

converted dollars-to-pesos and pesos-to-dollars. Tourists were *not* allowed inside (I was a tourist), and a guard at the door - with a machine-gun - enforced this policy. And of course, the exchange-rate was different in that bank, than

in the "kiosks" that the tourists could go to, to convert their funds.

It's always gonna be like this - and when it is *not* like this - the money (or the "securities", or the crypto-coins) probably are not going to retain their value.

The value of a fiat currency comes from it's link to a real, productive economy.

The value of crypto-currency is like stock, and comes from it's link to some fiat currency.

And with the FTX crash, bankruptcy and then with the emptying of

the entire FTX company "wallet", of FTT tokens, (still supposedly worth $622 million), we see a very familiar pattern of fraud and failure.

But who will want to accept FTT tokens, as payment for anything real, now that FTX no longer exists?

Looks like bullshit to us.

But Bitcoin might survive, since it really is distributed, runs on a proof-of-work blockchain, and is limited to 21 million "coins". But it is not *currency*. It is just an asset-class, again, like

a "security", with it's value resting completely on it's ability to be converted into USA dollars, or some other State-backed fiat currency. And like a stock, that value rises and falls with market conditions, human feelings, and buy and sell actions

of market particpants.

Exactly like a stock. But an unregulated stock-exchange carries risk. Bitcoin trading on a block-chain is simliar to the late 1800's "Curb Exchange" - a bunch of guys trading unregulated stocks, out on the

street, near the New York Stock Exchange. It worked - more or less -

for a while, until it was recognized as just silly, and it moved into a building, created some trading regulations and rules, and became the "American Stock Exchange."

If crypto-currency survives as an asset class, it's use will probably track a similar path.