[ Socialist Policy was always about more Inspectors, more Tariffs, and less Free and Open Trade. ]

Historically, Conservatives supported economic policies that reduced intrusive, abusive Government,

and stimulated and encouraged Free and Open International Trade and Commerce. It was the Socialists

that wanted to close borders and tariff-barrier trade. More trade = more jobs, and greater prosperity.

Globalism was a Conservative value, with trade being seen as a gateway to more wealth and opportunity.

Socialism was a different thing. It promised a closed society of inspectors, rules, regulations and

a loss of freedom and a loss of opportunity. Both Canada and the UK fought elections on these issues, as

these election posters from England in the 1920's show.

It was the Liberals in Canada that liked closed borders and high taxes. It was the Conservatives, under

Prime Minister Brian Mulroney and Finance Minister Michael Wilson (1984-1991) that got rid of the

awful 'Federal Sales Tax' (a job-killing hidden tax), created the visible Goods and Services tax, and

negotiated the Canada-US Free Trade Agreement, which benefited both USA and Canada massively, as our

history has shown. Wise Conservatives support Free Trade. Donald Trump is not a Conservative.

(Click on image to enlarge, click outside image, or top-right corner to return)

[ Thanksgiving Weekend in Canada. We are blessed. - Oct. 11, 2025 ]

We got kicked again on Friday, by that poltroon they have as the POTUS, down south of the border. But we own our land free and clear, and it yields. And it is also beautiful. We are blessed to live in Canada, a nation that is not run by cruel, dishonest and unwise bad people. Be thankful.

[ The Beautiful Conestoga River - from the Covered Bridge ]

This lovely view is not far from where we live. This local river was a highway for the explorers and the pioneers that developed this magnificent part of the world. Great Blue Herons can be seen regularly hunting for small fish and frogs along it's edges. We are lucky live here, in this most beautiful part of the planet.

[ Rolling Hills of Ontario. This amazing view is only a few miles from our farm. ]

The Land here is very beautiful. Sometimes, it is just breathtaking. These are glacial morraines from the Ice Age, about 25,000 years ago. Now, this landscape makes for fine agriculture, in a gentle climate. The "Physiocrat" Economists of France might have been right. Maybe all real wealth does come from the Land. You cannot eat semi-conductors, and you cannot drink digital ale. "Adam's Ale" is needed. :)

[ The Lure of Silver ]

An antique gift, made from a Hong Kong dollar, and a Japanese one-ounce trade-yen silver coin. I was told, it had been a wedding present, to a couple where one was Chinese, and the other Japanese.

Here is how we replace the US dollar for international trade. We just use 1-oz silver coins, like we did back at the beginning of the 20th century. These kinds of coins have been money for thousands of years. And the XRF (X-ray fluorescence) devices allow accurate, non-destructive verification of exact amount of precious metal content in any coin or bar of silver or gold. And of course, we do not need to physically exchange the coins. No reason they cannot be tokenized, put on a public block-chain, and transacted electronically as stablecoins with a specific 1-oz metal content. Given what is happening in USA, use of the US-dollar as the global reserve currency seems to be a questionable idea, fraught with rising levels of real risk. [Update, Oct. 12, 2025] I wrote the above, many months ago, back near the beginning of 2025. Silver hit $50/oz. last week. Real money - silver and gold - looks like it is gaining traction. Watch and learn. The USA is a giant econ-lab now.

[ The Curious Nature of War. It Brings Rapid Technological Improvement ]

Picture of my father's Bristol-Bolingbroke Bomber Trainer from World-War Two. These aircraft were used in Canada as training aircraft, to teach bomber crews how to drop bombs on European targets. These aircraft were also used for maritime patrol and homeland defence. They were licensed built in Canada, by Fairchild-Canada, to replicate the design of the Bristol Blenheim fighter-bomber, which was an English designed aircraft. They were set up for training with cameras, and my father would teach his students how to "camera-bomb" targets around Algonquin Park.

War is exciting, but it also destroys beautiful cities, and the lives of those who live there. But fear-of-war must not make free people accept illegal action and murderous aggression. There are times when war (kinetic, trade or radiant) becomes necessary and inevitable.

We should avoid war, if we can. But not at the price of freedom.

Research log updates:... (click "Research Log" above to jump to the log-page)

[Jan. 23, 2026] - The Astonishing Ignorance of History, By So Many Who Should Know Better

[Jan. 22, 2026] - Greenland Framework Deal - And Why Stock Prices Are Going Up

[Jan. 20, 2026] - Munger's Rule

[Jan. 19, 2026] - Article 25 is Calling ...

[Jan. 17, 2026] - The Subscription Economy and Imperial Madness

[Jan. 13, 2026] - Martingale Trading Simulator

[Jan. 12, 2026] - The Time Of The True Crazy (and Martingale Betting)

[Jan. 09, 2026] - The Breaking of America - Part 2

[Jan. 08, 2026] - The Breaking of America

[Jan. 06, 2026] - There Are No Rules

[Jan. 04, 2026] - Bombing Cities, Killing People, Kidnapping The President

[Jan. 03, 2026] - War-Maker America (*updated*)

[Jan. 01, 2026] - Results of a Curious Failure

[Dec. 30, 2025] - What Is Actually True?

[Dec. 29, 2025] - The Old Firm of "Wrong and Wronger"?

[Dec. 23, 2025] - More Worst-Case Scenarios

[Dec. 22, 2025] - Problems, Problems

[Dec. 19, 2025] - Crouching Fibre, Hidden Telecom (Value)

[Dec. 17, 2025] - Little Willy And The Wrong World

[Dec. 16, 2025] - The Curious Nature Of The Growing Harm

[Dec. 15, 2025] - A Curious Sense Of Foreboding

[Dec. 14, 2025] - Yo Ho Ho And A Bottle of Jack!

[Dec. 13, 2025] - Always Keep A Diamond In Your Mind

[Dec. 12, 2025] - Melencolia I

[Dec. 10, 2025] - We're On A Road To Nowhere

[Dec. 09, 2025] - Eraserhead Meets Godzilla

[Dec. 08, 2025] - Running on Empty?

[Dec. 05, 2025] - 5 Reasons To Be Cheerful

[Dec. 04, 2025] - Blues In The Night

[Dec. 03, 2025] - Imaginary World

[Dec. 02, 2025] - The News Is Noise

[Dec. 01, 2025] - The Big Event?

[Nov. 30, 2025] - The Elusive 10-Bagger

[Nov. 28, 2025] - Boom! Bang! **CRACK!** and then phhhtt...

[Nov. 27, 2025] - How About A Nice Game Of Solitaire?

[Nov. 26, 2025] - The Big World Of The 1960's

[Nov. 25, 2025] - The Comedy Of The Curious Numbers

[Nov. 24, 2025] - Mozart And The Bouncy Castle Of Damp Dreams

[Nov. 23, 2025 - Part Deux] - Zero Truth? - The True Truth Is Where The Money Is

[Nov. 23, 2025] - The Alternate Plan For America - The APFA !

[Nov. 22, 2025] - Sovereign Survival

[Nov. 21, 2025] - Spandau Memories...

[Nov. 20, 2025] - It's 11:59 With Diogenes

[Nov. 19, 2025] - Things At Her Fingers

[Nov. 18, 2025] - I Told You To Turn!!!

[Nov. 17, 2025] - Who Doesn't Love A Good, Firm Bottom?

[Nov. 14, 2025] - This Is The End of the Beginning

[Nov. 13, 2025 - Part 2] - This Is The End

[Nov. 13, 2025] - The Future Is No Fun Anymore

[Nov. 12, 2025 - Part 2] - Maybe We Are Now Here...

[Nov. 12, 2025] - New Tunes From The Covid Bats

[Nov. 11, 2025] - The Astonishing Art Of Being Wrong

[Nov. 9th, 2025] - The Blowoff?

[Nov. 7th, 2025] - The Time of All Lies

[Nov. 6th, 2025] - The Economic Consequences Piece

[Nov. 5th, 2025 - Part2] - Armed Terrorists Sieze Teacher At Chicago School

[Nov. 5th, 2025] - "Captain, She Canna Take Any More..."

[Nov. 4th, 2025] - Part 2: Things Are Not As They Seem

[Nov. 4th, 2025] - Crazy Can Happen

[Nov. 3rd, 2025] - We've Lost An Engine, And Are Losing Altitude...

[Nov. 2nd, 2025] - The Smart Money Is Quietly Going To Cash

[Nov. 1st, 2025] - The Imbecilic Buffoon In The White House

[Oct. 30, 2025] - Doing Business With Criminals Is Not Acceptable

[Oct. 29, 2025] - Delta Blues And Primer Gray

[Oct. 28, 2025] - The King Who Would Be Man

[Oct. 25, 2025] - Doug Ford Has Just Impeached Donald Trump. Amazing!

[Oct. 24, 2025] - Donald Trump Can F*ck Off

[Oct. 23, 2025] - Hacking the Gray Wetware

[Oct. 22, 2025] - The Days of Ancient (Memories)

[Oct. 21, 2025] - Blue Skies

[Oct. 20, 2025] - The Debasement Trade

[Oct. 18, 2025] - Three-Word Horror Story?

[Oct. 17, 2025] - Magic

[Oct. 16, 2025] - Laser Pulse - How Did Larry Lose It All?

[Oct. 15, 2025] - Happy/Happy/Joy/Joy - Or Maybe Not

[Oct. 14, 2025] - My AI's Are Better Than The Analysts

[Oct. 13, 2025] - Microeconomics And The Golden Compass Of Truth

[Oct. 12, 2025] - On the Road (To Hell!) Again...

[Oct. 11, 2025] - Why Friday Market Collapse Happened - And An Easy Forecast To Make

[Oct. 10, 2025] - Gunning For Stops, or Stopping For Guns?

[Oct. 09, 2025] - The Beelzebubble And The North-AM Horn Of Plenty

[Oct. 08, 2025] - Fucking Hell

[Oct. 07, 2025] - Fool On A Hill

[Oct. 06, 2025] - The Medium in the Message ("I Can't Complain, But Sometimes I Still Do...")

[Oct. 04, 2025] - The Darkness From Quantico

[Oct. 02, 2025] - The Muppets Of Trump And The Myth Of The "Deep State"

[Oct. 01, 2025] - All Quiet On The American Front

[Sep. 30, 2025] - Shut it Down! Please!

[Sep. 29, 2025] - TEA for Two Watts

[Sep. 28, 2025] - Invitation To The Blues

[Sep. 27, 2025] - The Great Quantico Cluster-Storm of 2025

[Sep. 26, 2025] - Everything On The Internet Is Fake

[Sep. 25, 2025] - Moonstruck Plumber

[Sep. 24, 2025] - Repair What's Broken And Fix The Problems

[Sep. 23, 2025] - What Do You Want From Life? (The Tubes)

[Sep. 22, 2025] - The Wild Sea

[Sep. 19, 2025] - Meanwhile, Back At The Ranch...

[Sep. 18, 2025] - Dancing With Mr. D.

[Sep. 17, 2025] - Bang A Gong

[Sep. 16, 2025] - Still Alive And Well

[Sep. 15-b, 2025] - YOU Are The Product

[Sep. 15, 2025] - Running With The Devil

[Sep. 13, 2025] - Honest Tiger, Hidden Truth

[Sep. 12, 2025] - Distribution Day!

[Sep. 11, 2025] - What Do You Americans Expect???

[Sep. 10, 2025] - Trust Busters 21st-Century Style

[Sep. 09, 2025] - Madness Takes Its Toll

[Sep. 08, 2025] - Lure Them In, Then Shake Them Down

[Sep. 06, 2025] - Pay No Attention To The Man Behind The Curtain

[Sep. 05, 2025] - A Bicycle Built For 200

[Sep. 04, 2025] - The Market Is Insane

[Sep. 03, 2025] - Always Crashing In The Same Car

[Aug. 27, 2025] - Sudden Burst of Sanity

[Aug. 26, 2025] - Wreck of the Old '97

[Aug. 23, 2025] - Runaway Train?

[Aug. 20, 2025] - Fat Red Cherries and Fine Sweet Peaches

[Aug. 19, 2025] - World Of Water

[Aug. 15, 2025] - Work Continues...

[Aug. 14, 2025] - Stupid World

[Aug. 08, 2025] - We, Robot

[Aug. 07, 2025] - Power to the Boat People

[Aug. 06, 2025] - Louis-Louis, We Gotta Know... (our position)

[Aug. 04, 2025] - Smoke Gets In Your Eyes

[Aug. 01, 2025] - The Beginning of the SHTF?

[July 31, 2025] - Fortuna Imperatrix Mundi

[July 30, 2025] - Flying Shoes

[July 29, 2025] - Sally Swing

[July 28, 2025] - The Tax Man Trump

[July 25, 2025] - Trouble Power

[July 24, 2025] - Blondie Bondi Told Him - "You In Da Epstein Files, Fat-Boy!"

[July 23, 2025] - Seven Screaming Diz-Busters?

[July 21-22, 2025] - In a Big Country...

[July 18, 2025] - Donald Trump is Compromised?

[July 17, 2025] - True North

[July 14, 2025] - The Summer of Shove

[July 13, 2025] - The Tube Alloy Blues

[July 12, 2025] - The Bogus Anti-Christ of Economics?

[July 11, 2025] - South Park Trailer Boys of Finance

[July 09, 2025] - The Economics of Marquis de Sade

[July 08, 2025] - You Want It Darker

[July 07, 2025] - Israel Is Evil

[July 06, 2025] - It's Almost Like The Blues...

[July 05, 2025] - Lies, Damned Lies, Statistics, and CNN

[July 04, 2025] - God Save America

[July 03, 2025] - Fiat Lux

[July 02, 2025] - America as an Out-of-Control Mass-Murderer?

[June 30, 2025] - The Importance of Trust

[June 28, 2025] - News Is A Plate of Clickbait. Just Avoid News.

[June 26, 2025] - Clouds of Uncertainty

[June 24, 2025] - Let's Have a Ceasefire... (We need to re-load)

[June 23, 2025] - Is Karma Real?

[June 22, 2025] - Crazy War Begins

[June 21, 2025] - Summertime (and the ICE-fascism is easy)

[June 20, 2025] - The More I Read, The Worse It Looks

[June 19, 2025] - The Will of The "Triumph" (Will Diego Garcia get nuked?)

[June 17-18, 2025] - The Ugly American?

[June 15, 2025] - Neural Net Without TF

[June 13, 2025] - The War-Pigs of Israel Go Out for More Murder - This Time, Tehran

[June 12, 2025] - GENERAL STRIKE?

[June 11, 2025] - Sine of the Times: E PLURIBUS FUCK'EM!

[June 10, 2025] - Liars On The Norm

[June 09, 2025] - Boom, Boom. Out Go The Lights

[June 07, 2025] - The Sisyphus of Myths

[June 06, 2025] - Myths That Help Us

[June 05, 2025] - Everything You Know Is Wrong

[June 04, 2025] - The Beat Goes On

[June 03, 2025] - Mad World

[June 02, 2025] - Spirit In The Sky

[May 31, 2025] - Hana Says Maybe It's Time To Buy

[May 29, 2025] - Sh/t That Works - Predictive AI

[May 28, 2025] - Boomtown Hacks (and Boomtown Sacks)

[May 27, 2025] - Asian Surf Music

[May 23, 2025] - 7 Days in May - USA Trumperites Declare War on American Universities as Money Begins to Die

[May 21, 2025] - The Washington DC ShitShow of Comedy

[May 20, 2025] - Here Comes the Sun (Burst?)

[May 15, 2025] - Cursum Perficio

[May 14, 2025] - Running on Empty

[May 13, 2025] - Saviour Machine

[May 10, 2025] - She's Got Medals! (But Can She Wear Them?)

[May 09, 2025] - Tears for Fears, Cheers, Smears and Beers

[May 07, 2025] - Problems, Problems...

[May 03, 2025] - Elvira Madigen?

[Apr. 23, 2025] - Roach Motel Market

[Apr. 22, 2025] - Ok, So What Do We Do?

[Apr. 21, 2025] - Robert Johnson, Faust and The Devil

[Apr. 20, 2025] - Did the Rhine Just Freeze Over?

[Apr. 18, 2025] - Stupidity As A Powerful Force

[Apr. 17, 2025] - Blank Me Baby! 8 to The Bar

[Apr. 16, 2025] - Holy Moly! The Google Generative AI is Good.

[Apr. 15, 2025] - Bad Dreams: The Vortex Replaces the Matrix

[Apr. 14, 2025] - Pay No Attention To The Man Behind The Curtain

[Apr. 13, 2025] - First, Do No Harm

[Apr. 11, 2025] - Friday Times

[Apr. 10, 2025] - It's 1, 2, 3, 4 What Are We Waitin' For? Don't Ask Me, Don't Give a Damn! Next Stop is Vietnam!

[Apr. 09-c, 2025] - Stock Market Says: "Ha Ha Ha, Fooled Ya!"

[Apr. 09-b, 2025] - Instead of Drill-Baby-Drill, We Got Fall-Baby-Fall

[Apr. 09, 2025] - The Big Treasury Share Telephone Scam

[Apr. 08b, 2025] - Anti-Liquidity and War

[Apr. 08, 2025] - Bare Markets (Who is Swimming Naked?)

[Apr. 06, 2925] - Helter-Skelter Economics

[Apr. 05, 2025] - Instant Karma Gonna Get You

[Apr. 04, 2025] - Insane Times and Really, Really Simple Calculus

[Apr. 02, 2025] - Not That Pretty At All...

[Apr. 01, 2025] - Killer On The Road! (His Brain is Squirming Like a Toad!)

[Mar. 31, 2025] - Chariots of Ire

[Mar. 30, 2025] - The High-Cost Trump Screws and The Unwise Attack On Free Trade

[Mar. 29, 2025] - #^*% AWS And It's Stupid MFA Gunk

[Mar. 28, 2025] - Bad Moon Rising?

[Mar. 27, 2025] - MAGA = Make America Go Away!

[Mar. 26, 2025] - Ranchero!

[Mar. 25, 2025] - The Death Cross or the Cross of Death?

[Mar. 20, 2025] - Spring Annihilates Winter

[Mar. 18, 2025] - Crazy Freakin' Hypershite

[Mar. 17, 2025] - Happy St. Patrick's Day

[Mar. 16, 2025] - USA - So Very Special...

[Mar. 15, 2025] - The Ides of March

[Mar. 14b, 2025] - Lunar Eclipse and Fun With Nucleoprotein Chemistry

[Mar. 14a, 2025] - This Really is Getting Crazy...

[Mar. 13, 2025] - Pogue Mahone!

[Mar. 12, 2025] - The Bay of Jigs...

[Mar. 11, 2025] - Donald Trump Might Actually Be Insane

[Mar. 10, 2025] - Always Crashing In The Same Car

[Mar. 09, 2025] - Killing Me Softly...

[Mar. 07, 2025] - World Out of Balance

[Mar. 06, 2025] - New Theme: "America can go Fuck Itself!"

[Mar. 04, 2025] - Madness Takes It's Toll...

[Feb. 28, 2025] - One Hand is on the Tight-rope Walker ...

[Feb. 27, 2025] - The AI Says Up. We Find This Hard to Believe...

[Feb. 26, 2025] - A Garbage Market, or a Market of Garbage?

[Feb. 25, 2025] - The Price of Foolish Failure

[Feb. 21, 2025] - Pricing In the Coming Storm

[Feb. 20, 2025] - Life on Mars...

[Feb. 19, 2025] - The Coming Storm - or - Roll Away the Stone?

[Feb. 18, 2025] - The Low Spark of Well-Heeled Boys

[Feb. 14, 2025] - Grand Illusion and Black, Black Hearts

[Feb. 12, 2025] - Weather From Hell

[Feb. 07, 2025] - In the Deep, Deep Mud...

[Feb. 06, 2025] - In-Sanity In-Charge?

[Feb. 05, 2025] - Changes

[Feb. 04, 2025] - Life in the End Times? Perhaps.

[Feb. 03, 2025] - Donald Trump Attempts to Destroy the North American Economy. Hilarious!

[Feb. 02, 2025] - The Time of The Great Stupid!

[Feb. 01, 2025] - A Comedy of Errors

[Jan. 31, 2025] - Cute Winter Boots And The Drop-Toad

[Jan. 30, 2025] - Crazy Dancing IP Numbers!

[Jan. 29, 2025] - Enjoy Yourself, It's Later Than You Think!

[Jan. 27, 2025] - DeepSeek R1 for US! (Deepshit for Big-Tech Monopolists?)

[Jan. 26, 2025] - The Lure of the Unreal

[Jan. 24, 2025] - Astronomy

[Jan. 23, 2025] - Ta Ra Ra BOOM Dee, Eh? (Throne of Blood)

[Jan. 22, 2025] - Eaten By Eighths - A Ranting Full Stop...

[Jan. 21, 2025] - Rain On The Windshield Heading South

[Jan. 19, 2025] - Senses Working Overtime?

[Jan. 17, 2025] - The Hard-Wired Drop-Toad

[Jan. 16, 2025] - Molly Malone Works Alone

[Jan. 15, 2025] - May The Wind Take Your Bubbles Away!

[Jan. 13, 2025] - The Incredible Shrinking Internet

[Jan. 09, 2025] - Reviewing the "Enron Egg" - Portable Household Level Nuclear Reactor + Generator

[Jan. 07, 2025] - The Big Barkers of the "Big Tech" Grift

[Jan. 03, 2025] - Flaming Zepplins, Running 7's

[Jan. 01, 2025] - Back Online. We were knocked off by some sort of AWS (Amazon Web Services) policy

change or something, which prevented login to AWS Console, and also prevented access to our EC2 instance.

(our virtual server, running our website.) As of New Year's Day, it all

seems to be working again. I had planned to re-factor this messy website over the holidays, but lost

AWS access as of Christmas Eve. So much for "Cloud". We run local AI's, and wow - is local-system

operation the only way to go. If you surrender your control to some remote technical service, you

are taking a serious risk. See "Research Log" for more details...

[Dec. 24, 2024] - It Came Upon A Midnight Clear

[Dec. 20, 2024] - Your Baby's Gone Down the Plug-Hole

[Dec. 19, 2024] - Error 404 => Future Failure!

[Dec. 17-18, 2024] - Electro-Curious

[Dec. 16, 2024] - Are You Experienced?

[Dec. 12, 2024] - Cyber-Truckin! Really! I'm Most Grateful To Be Not Dead!

[Dec. 11, 2024] - Wayfaring Stranger

[Dec. 10, 2024] - Both Mother and Daughter

[Dec. 06, 2024] - Phasers on Stun

[Dec. 05, 2024] - On The Beach With Suzanne

[Dec. 04, 2024] - Getting It In the Ear - cf. Iggy Pop

[Dec. 03, 2024] - Green Onions - Roasted Or Fried

[Nov. 28, 2024] - Happy Thanksgiving (and a Note on Civil War)

[Nov. 25, 2024] - Atomic Balm

[Nov. 19, 2024] - Hey! Ho! - And Up She Rises!

[Nov. 18, 2024] - Riverboat Gambling...

[Nov. 17, 2024] - Member's Only (It's a Private Party)

[Nov. 15, 2024] - "Swingin'" - by Tom Petty

[Nov. 14, 2024] - Wild World ("Dreamscape Injection")

[Nov. 13, 2024] - Let's Do the (Linux) Time Warp Again!

[Nov. 12, 2024] - Walk the Dog

[Nov. 11, 2024] - Resilience Continued - How I Fixed CentOS-7 and Xorg Server So it Worked Again...

[Nov. 10, 2024] - Astrolabs and Resilience

[Nov. 07, 2024] - Hanging on the Telephone (or from the Telephone?)

[Nov. 06, 2024] - Venus on a Lox and Bagel... or Cities Aflame?

[Nov. 05, 2024] - Child (Just) In Time

[Nov. 04, 2024] - London Bridge is Falling Down

[Nov. 01, 2024] - A Plea in Favour of Market Transparency

[Oct. 31, 2024] - Leverage, Debt and the Floating World of Finance

[Oct. 29, 2024] - Samsung Galaxy Tab A9+ is actually pretty good. VLC works well.

[Oct. 27, 2024] - My Android Apps Loaded on new Samsung Tab A9+ ... Whoo-hoo!

[Oct. 25, 2024] - Clickbait and Real Estate

[Oct. 24, 2024] - The Astonishing Enshitification of Google's Android!

[Oct. 23, 2024] - The Golden Mean (and the Meaning of Gold)

[Oct. 22, 2024] - I Don't Like Mondays...

[Oct. 17, 2024] - Food and Money...

[Oct. 15-16, 2024] - Swim Out Past the Breakers...

[Oct. 09, 2024] - Desolation Row (And The Skank of Nova Scotia?)

[Oct. 08, 2024] - Dr. Geoffery Hinton Wins the Nobel Prize in Physics! Congratulations!

[Oct. 07, 2024] - A Note for You Who Seek the Truth.

[Oct. 06, 2024] - Elon Musk's Speech with Trump in PA. (You gotta watch this...)

[Oct. 05, 2024] - Amazon & EC2 (and this site!) working fine, and now https:// works...

[Oct. 01, 2024] - Fields of Regret?

[Sep. 27, 2024] - Message from the Lizard Brain

[Sep. 26, 2024] - The Devil's Blues (and the Mean-Reds, maybe?)

[Sep. 23, 2024] - Klatu, barada nicto, eh?

[Sep. 17-20, 2024] - Endless Summer

[Sep. 13, 2024] - Run... (Away?)

[Sept. 7, 2024] - Updated the GEMESYS AI projections for our main holding (see below)

[Sept. 6, 2024] - Robots Waving Arms

[Sept. 5, 2024] - Blue Skies

[Sept. 4, 2024] - Rover-Packs?

[Aug. 29, 2024] - Risk is Real

[Aug. 28, 2024] - Sheena is a Punk Rocker

[Aug. 23-24, 2024] - DDG versus Google, How Canada Got Born, Free Trade

[Aug. 22, 2024] - Long or Wrong...

[Aug. 21, 2024] - The Real War of the Coloured Swans

[Aug. 20, 2024] - Rather Hope I'm Wrong...

[Aug. 18, 2024] - The Plan for the Destruction of America?

[Aug. 17, 2024] - Worst Case Degenerate Economcy

[Aug. 16, 2024] - Debt Growth and De-coupling

[Aug. 12, 2024] - Insanity?

[Aug. 7, 2024] - Astronomy

[Aug. 6, 2024] - Markets Fibrillate. October Re-Pricing Expected. War-costs coming.

[Aug. 5, 2024] - Madness of Crowds Accelerates

[Aug. 1st, 2024] - A Very Good Speech

[July 30, 2024] - Overvaluation & The Best Trade Ever

[July 27, 2024] - Wheeee!

[July 25, 2024] - October Surprise?

[July 24, 2024] - Everything's Turning to Shit.

[July 23, 2024] - The Kamala Malady of Malfunctioning Malinvestments

[July 22, 2024] - The Essence of Science

[Update: 16:09 July 21, 2024] Just heard Biden dropped out. Our forecast was off by one day.

[July 21, 2024] - Hey Joe! Where You Going With That Ballot-box in Your Hand?

[July 19, 2024] - Sad Idiots at Crowdstrike Manage to Strike the Whole World, in Mass-Stupidity Deployment

[July 18, 2024] - "Tomorrow Belongs to Me!" (says the Maker-Kid with a Lathe, a Circuit-Board, and a Soldering Iron... )

[July 13, 2024] - Trump shot at rally in Butler Pennsylvania. Stood up, with blood on face and neck. Raised his fist.

[July 11-12, 2024 update:] AI projections negative, but trumped by mild inflation print.

The "Research Log" button has - the research log! You can follow our Perilous Experiments.

With the research log, and our videos, You can follow our Perilous Experiments!

Remember: "Vita Brevis, Ars Longa, Ocassio Praeceps, Experimentum Periculosum & Iudicium Difficile." (Trans: Life is short, Mastering the Art takes a Long Time, Opportunity is Fleeting and Falls Away Easily, Experimentation is Dangerous, and Judgement is Difficult.)

Page down to page-bottom, to see our forecasts from our AI, for one of our main holdings. The AI works better than the humans, which is why AI is so popular. Humans are bad investors. They sell at the lows, and buy at the tops. The AI-driven model can do the opposite, since it has no emotions. Simple as that, it is. [Update: New Projection as of June 03, 2025 - page down to view]

(Note: If you are running an OLD browser, and this button does not work, you can view our Research Log page by clicking on: http://www.gemesysresearch.com/Gemesys_Page_2.html )Everything Going to This...?

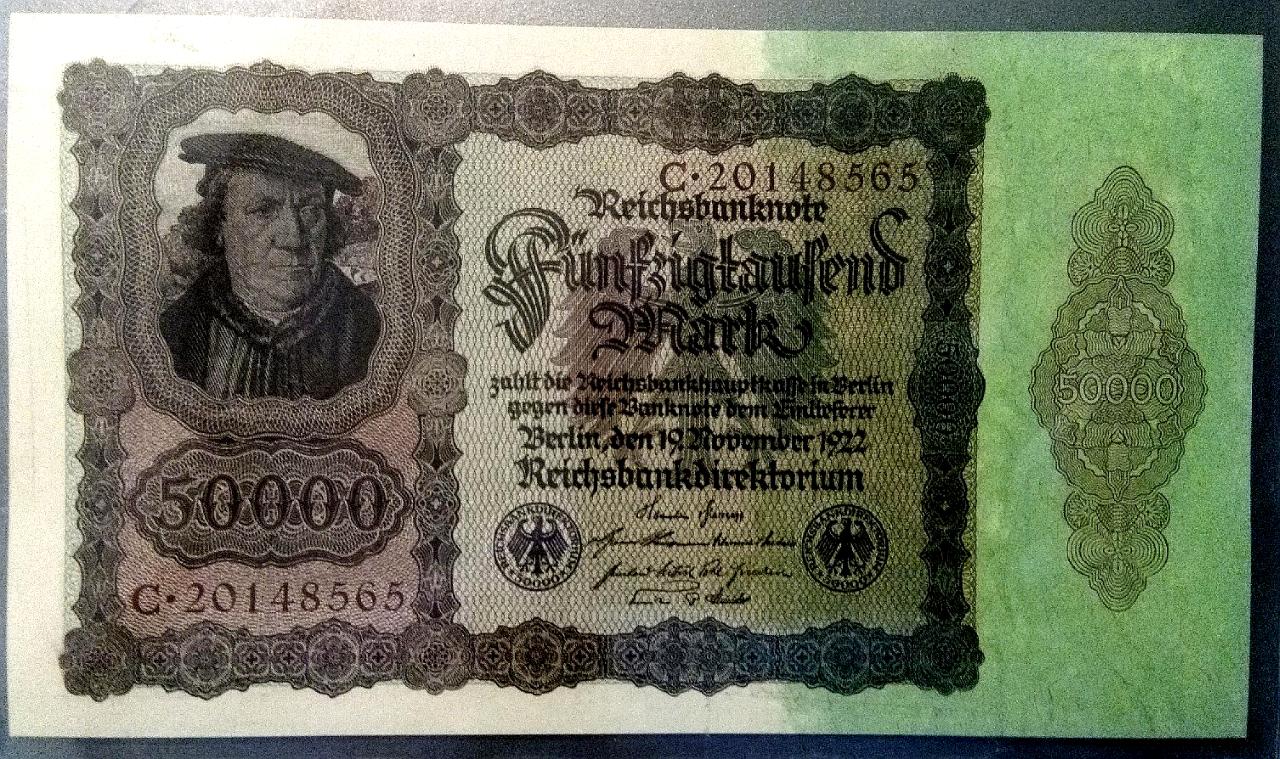

Here is a picture of the past - and maybe the future???

[ Is Money Going to Die ... ? ]

Here is 50,000 Mark Note, from the beginning of the German Hyperinflation of the 1920's. This is from the early days - the bill is dated 19 November, 1922. By 1924, these 50,000 Mark notes ("Funfzigtausend Mark") had so little value, they were basically worthless. But the production quality of this bill is very high, as it was a large-denomination bank-note when it was created. It has several colours, black/brown, red and green, and the engraving quality is very fine. I bought it from a collector, and it cost me real money - close to $20 Cdn. This is the great irony of History. The worthless can become valuable, and the valuable can become worthless. Karl Marx was so very dishonest - or very stupid. All economic value exists solely in the mind of the buyer. When economic value is assessed differently between different agents, perhaps a transaction can take place, and greater value can be created. Labour-input to the production process, is completely irrelevant. Know this truth.

(Click on image to expand it, and ESC to exit expanded image.)

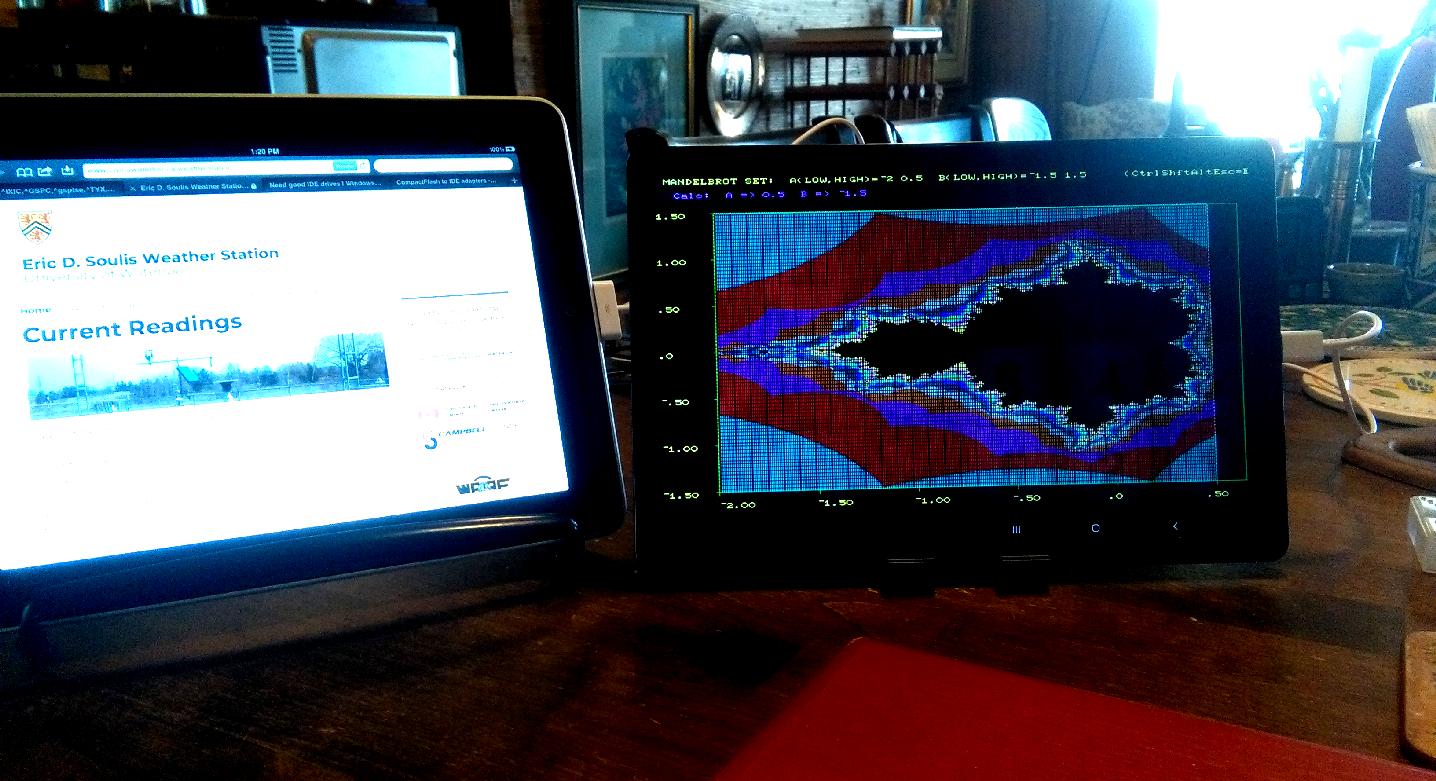

[ The new Samsung Galaxy Tab 9A+, o/s: Android-14, running the GEMESYS APL to produce the Mandelbrot Set graphic. ]

This shows the new Samsung Galaxy Tab 9A+, running the GEMESYS APL, to produce an image of the Mandelbrot Set. The

image took over an hour to generate (the APL runs an emulator, on an emulator, under an emulator, so it is not

lightening fast. But the numbers are correct. Whoo hoo! The various GEMESYS APL's can be downloaded from the

GEMESYS Github site, and with "adb", the .apk files can still be loaded onto modern Android systems, if the

parameter "--bypass-low-target-sdk-block" is used. Assuming "adb" (running on your P/C under Linux or Windows)

reports a device name such as: R92X305A6JK, when you enter "./adb devices" to get a list of attached devices, then,

you can enter the "adb" command:

./adb -s R92X305A6JK install --bypass-low-target-sdk-block APLse-release.apk

to load the .apk file. Note that R92X305A6JK is the device name, which will be different for each device.

There are two good APL's offered by GEMESYS Ltd, which are free, have no tracking, and no "in-app" adverts

or purchase trickery.

They are experimental/educational software for learning purposes. I built these APL's for Android, because learning and using APL to solve otherwise almost-undoable problems, really helped me, and made my good life possible. I felt I should help this wildly useful language avoid death. APL's author, a cranky fellow named Ken Iverson, died a while back. In it's day, APL was the most highly-used language inside of IBM. It's a language of n-dimensional, matrix-data. For me, APL basically WAS the matrix. Learning it, was a true "red-pill" experience. :)

APLse is good, as it can do graphics. The other

APL that is good, is the old I.P. Sharp APL, called: sAPL-release.apk. The APL .apk files and DOSbox can

be downloaded from the GEMESYS Github software repository. Here is the link below:

https://github.com/Gemesys/gemesys_repository

There is also a GNUplot Ver. 37, for quicky charting on your Android device, (Try: "Plot sin(x)" to demo it) and also a version of DOSbox, which can be downloaded and then installed with a USB tether to the Samsung Tab 9A+, using "adb", the "Android Debug Bridge" software.

(Click on image to expand it, and ESC to exit expanded image.)

Click on the ** Research log ** button at top of page for more notes on our "Dismal-Science" view of things.

GEMESYS Ltd. Research & Consulting: We Live in Truth, Offer Enlightenment and if your projects and plans

are in trouble, we can help you Change the Program!. Make new choices while you still have freedom of action!

[November 21, 2025] - The MPM medium-freq predictor is now pointing up sharply. It is in agreement with the other

higher-frequency model.

This is not to be considered an exercise in investment advice. Make your own decisions, please.

Both this model, and the other high-frequency model, are pointing towards a higher share price. I believe that at least one major bank's research group has put a $99/shr target price on this stock. We think that actually, that is probably a tad low - we are looking at the 110 to 120 range. Canada may become the Switzerland of North America, instead of being the Argentina of North America. Might take a new Gov't to make this happen, but this might be in the cards, if the Conservatives can do a reset. We think the USA will experience some very big changes soon. No one knows for sure, but too much is just wrong.

(Click on any Image to expand it, ESC to exit image-expansion.)

[November 21, 2025] - The two AI's now both pointing UP. The high-freq one here, is showing a sharp UP-trend is now expected. Full Disclosure: We unloaded back in October, but have now repositioned in bank-stocks. All-in. Mostly based on this. We might be wrong. :)

This information is not "Investment or Trading Advice". It is simply an honest reporting of our research efforts.

(Click on image to expand it, and ESC to exit expanded image.)